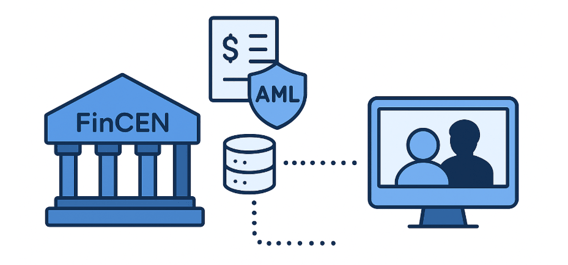

How FinCEN shapes AML compliance and secure data collaboration

The Financial Crimes Enforcement Network (FinCEN) is the U.S. authority responsible for safeguarding the financial system from money laundering, terrorist financing, and financial fraud.

Its regulatory scope has grown significantly, especially with the Anti-Money Laundering Act of 2020, which modernized the Bank Secrecy Act (BSA) to reflect digital and cross-border finance realities.

For financial institutions, FinCEN defines how customer due diligence, suspicious activity reporting, and beneficial ownership transparency must be executed — while maintaining secure data handling.

As financial systems become more digital, FinCEN’s challenge is balancing compliance transparency with individual privacy.

FinCEN’s key compliance requirements

Financial institutions under FinCEN’s jurisdiction must maintain AML programs that are both proactive and verifiable.

Core obligations include:

- Customer Identification Program (CIP): verifying identity before account creation.

- Customer Due Diligence (CDD): understanding ownership and risk profile of clients.

- Suspicious Activity Reports (SARs): detecting and reporting unusual transactions.

- Recordkeeping: maintaining traceable, auditable financial transaction data.

- Beneficial ownership registry: identifying the individuals behind corporate structures.

These rules apply across banks, brokers, fintechs, and virtual asset service providers.

Related: Read Customer Due Diligence (CDD) for more on risk-based verification frameworks.

AML Proof of Concept: How UK banks can collaborate on AML data without sharing private info

The tension between compliance and privacy

FinCEN’s expanded powers under the AML Act have created growing pressure on institutions to share more data.

However, broad data collection often conflicts with privacy and data protection regulations, especially for firms operating internationally.

Privacy-preserving computation provides a technical solution to this policy problem — enabling institutions to:

- Collaborate on AML detection models without exposing customer data.

- File Suspicious Activity Reports (SARs) through secure, multi-party analysis.

- Verify beneficial ownership while keeping personal data confidential.

- Meet U.S. reporting obligations while complying with GDPR and FATF standards.

This technology-driven approach aligns with FinCEN’s modernization strategy and global AML cooperation goals.

Related: See Privacy-preserving computation to understand the cryptographic principles behind compliant collaboration.

The compliance battlefield: Win the fight for your firm's future

Your firm is facing immense pressure from regulators like the FCA. New regulations like DORA and the upcoming eIDAS 2.0 are turning compliance from a burden into a battlefield. You're expected to manage risk, protect data under strict rules like GDPR, and avoid massive fines. Your current systems are simply not enough. Partisia is your strategic partner in building a more secure and profitable future.

What we solve:

- DORA & GDPR compliance

- eIDAS 2.0 & Digital Identity

and more.

FinCEN and global AML harmonization

FinCEN’s coordination with the Financial Action Task Force (FATF) and the European Banking Authority (EBA) aims to standardize AML practices across jurisdictions.

The move toward data-driven supervision requires secure, interoperable technology capable of connecting systems while maintaining national sovereignty over data.

Key areas of convergence include:

- Beneficial ownership transparency aligned with AMLD6.

- Information-sharing partnerships between banks and regulators.

- Technology adoption for AML data aggregation and risk analysis.

Related: See FATF Compliance Technology for how cryptography is redefining international AML cooperation.

“FinCEN has entered the data age. The next decade will be about verifying more while exposing less. Privacy technology will become a compliance requirement, not an option.”This reflects FinCEN’s growing focus on technology-based AML enforcement and information security.

– Partisia CPO, Mark Medum Bundgaard

Privacy-preserving collaboration for FinCEN compliance

Partisia helps institutions comply with FinCEN’s data-sharing and reporting requirements through Multi-Party Computation (MPC) and Confidential Computing. Its privacy-preserving platform allows multiple organizations to collaborate on AML and KYC workflows securely, without exposing underlying customer data.With Partisia, institutions can:

- Conduct cross-bank transaction monitoring securely.

- File compliant SARs through encrypted analysis.

- Link CDD data with beneficial ownership validation privately.

- Align FinCEN, FATF, and GDPR requirements in one verifiable process.

2025.08.20