PDF: UK AML & Fraud Detection Insights with FCA Collaboration

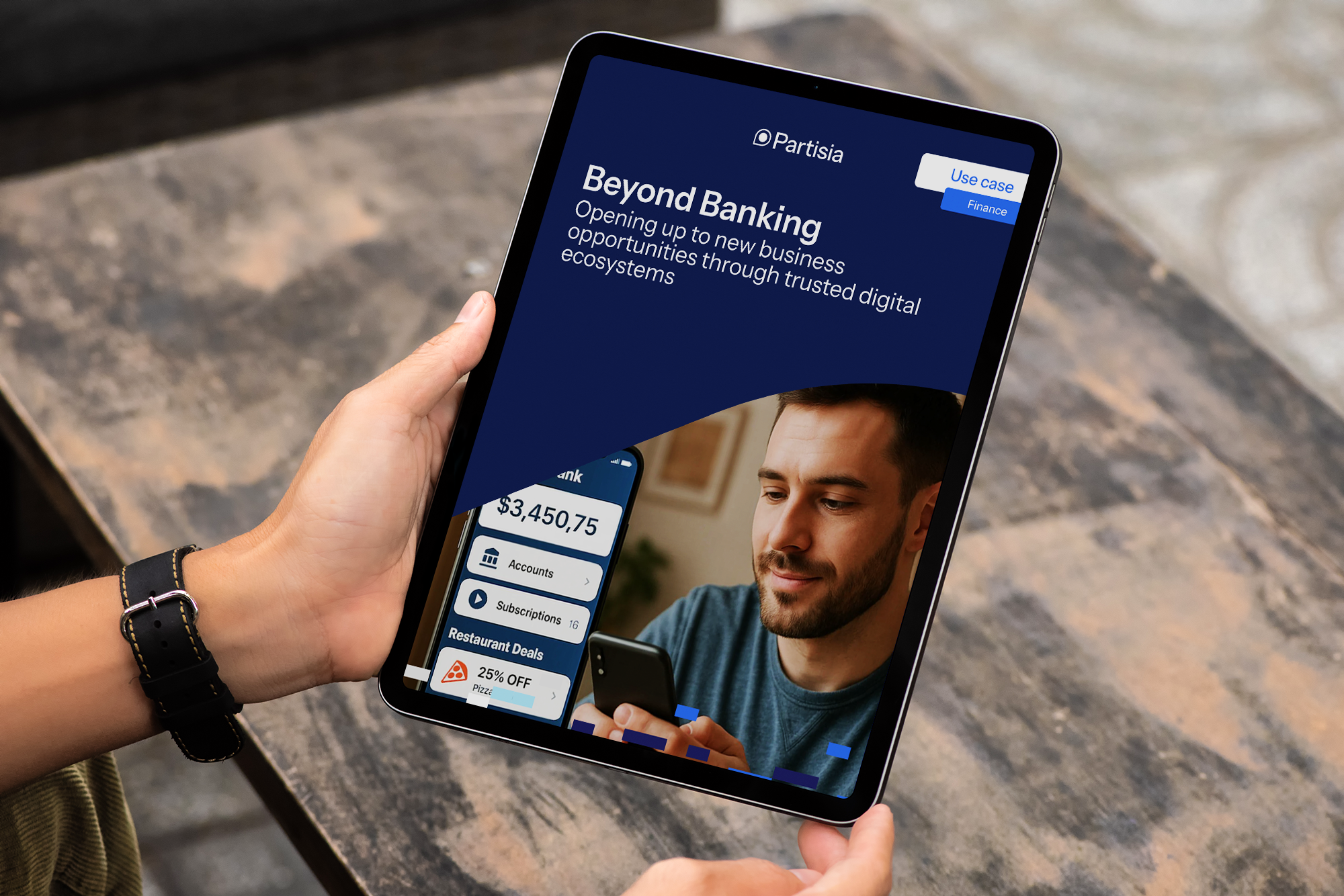

Strengthen AML & Fraud Detection with UK‑Focused Insights FCA’s blockchain-enabled data strategy aims to save up to £4 billion in annual compliance costs source. Implementing Partisia’s MPC framework reduces duplication in cross-bank fraud checks. Banks and financial institutions in the UK face ...