Fuzzy logic in fraud detection for financial services

Financial fraud has never been a static problem. As systems evolve and data volumes grow, fraudsters adapt. They exploit ambiguity, timing gaps, and patterns that traditional binary detection systems often miss. The problem is not that institutions lack data, but that their systems still tend to view the world in absolutes.

This is where fuzzy logic offers an advantage. It allows institutions to move beyond rigid true-or-false rules and detect suspicious activity based on degrees of likelihood. Instead of asking whether a transaction is or is not fraudulent, fuzzy logic asks how likely it is to be fraudulent. That subtle shift changes everything about how financial systems interpret risk.

What fuzzy logic actually means

The concept dates back to 1965 when computer scientist Lotfi Zadeh introduced it as a mathematical way to handle imprecise information. Traditional computing is binary: everything is either 0 or 1, yes or no. Fuzzy logic introduces the continuum between those extremes.

In fraud detection, this matters because transactional behavior is rarely clear-cut. A transaction might look unusual but still legitimate. A customer might behave erratically without any criminal intent. Fuzzy logic models handle this uncertainty by assigning values between 0 and 1 to represent degrees of truth.

For example, rather than using a rule such as “If a transaction exceeds €5,000, flag it as suspicious,” a fuzzy system might say “The higher the amount above €5,000, the more suspicious it becomes.” Combined with other factors like device location, merchant category, or time of day, the model creates a composite fraud score that captures nuance.

According to a study published in the International Journal of Research and Innovation in Applied Science, fuzzy logic approaches have achieved up to 20 percent higher accuracy than rule-based systems, primarily by reducing false positives.

Why traditional fraud detection systems fall short

Conventional fraud detection relies on deterministic rules: if condition X occurs, trigger alert Y. The problem is that these systems treat all thresholds as equal. A transaction just below the cutoff is ignored, even if other indicators suggest risk. Conversely, a legitimate transaction slightly above the threshold can trigger unnecessary investigations.

Binary systems also fail to adapt. Fraud strategies evolve faster than rule updates can be coded, leaving institutions perpetually reactive. Machine learning models offer improvement, but many are black boxes that struggle to explain why they classify an event as fraud. That lack of interpretability creates regulatory and audit concerns, especially under the EU’s data accountability standards. DORA regulation explained: What it means for financial institutions.

Fuzzy logic sits between these extremes. It allows transparent, rule-based modeling that can still handle uncertainty. The rules are interpretable, but the output is flexible. This makes it a useful complement to both traditional analytics and AI-based scoring.

How fuzzy logic works in practice

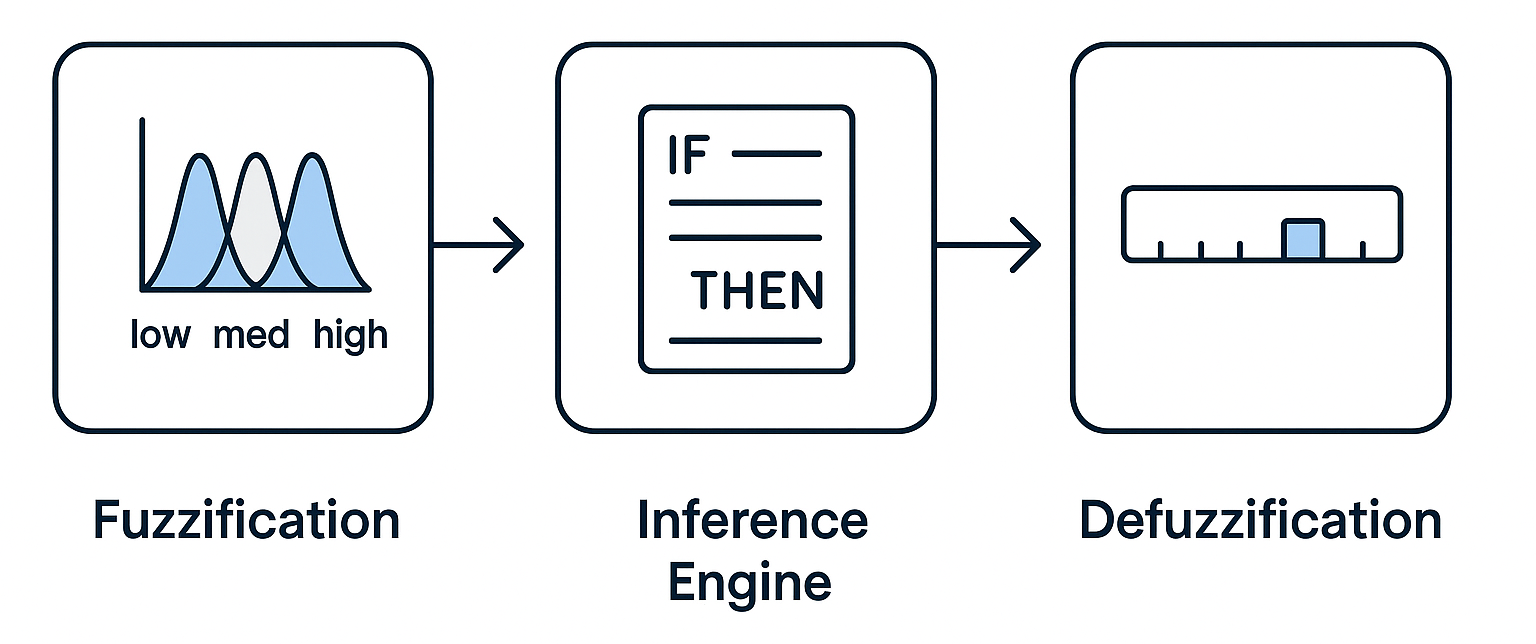

A fuzzy fraud detection system typically consists of three layers:

1. Fuzzification.

Raw inputs like transaction amount, merchant risk score, and device location are translated into fuzzy sets such as “low,” “medium,” or “high.” Each input is assigned a degree of membership within those categories.

2. Inference engine.

A set of rules then combines these fuzzy values. For example:

-

If transaction amount is high AND location risk is medium AND merchant category risk is high, THEN fraud likelihood is strong.

Each rule contributes to the final output based on its degree of truth.

3. Defuzzification.

The combined results are converted back into a crisp fraud score, typically between 0 and 100, which determines whether further review is required.

The advantage is adaptability. If a new fraud pattern emerges, the institution can simply adjust the membership functions or add new rules without retraining an entire model.

Applications in modern financial systems

Fuzzy logic is being integrated into payment gateways, card authorization systems, and real-time monitoring tools across banks and fintechs. It supports adaptive thresholds that respond to behavioral baselines. For example, a customer who regularly spends abroad may have a different “normal” range than one who rarely travels.

Fuzzy logic can also complement machine learning by serving as a pre-filter that reduces noise. By applying fuzzy scoring first, institutions can prioritize which transactions to send for deeper AI-based analysis. This layered approach improves efficiency and interpretability.

According to the European Banking Authority’s guidelines on ICT and security risk management, financial institutions must maintain effective, explainable fraud detection mechanisms as part of their operational resilience strategy. Fuzzy logic helps meet that expectation by providing explainable reasoning in real time.

How a new approach to financial crime could stop

fraud in its tracks

The proof-of-concept 2019 changed the frame: instead of judging each payment on its own, it followed how money travels across accounts and institutions. That shift revealed patterns single-transaction systems miss.

The scale is staggering. Financial institutions together spend an estimated $200 billion a year on compliance and AML, and yet fraud losses remain stubbornly high-costing banks and customers tens of billions annually.

What's inside?

-

Seeing the whole network

- A shared defense with measurable impact

and more...

Advantages and measurable outcomes

Institutions that have implemented fuzzy logic models report fewer false positives and faster detection cycles. Reducing false alarms matters because every unnecessary investigation consumes compliance resources and delays legitimate transactions.

The benefits extend beyond efficiency. Because fuzzy logic models can express uncertainty, they allow risk teams to calibrate tolerance levels more precisely. High-confidence alerts can be acted upon immediately, while medium-confidence alerts can be routed for secondary review. This prioritization improves fraud response time and customer experience simultaneously.

Fuzzy systems are also auditable. Each rule can be reviewed and justified to regulators, which is not always possible with opaque AI models. In an era when explainability is as important as accuracy, that balance is valuable.

The link to DORA and operational resilience

The Digital Operational Resilience Act is not just about technology failures or cyberattacks. It covers any operational disruption that could impact the financial system. Fraud incidents fall squarely into that category.

Under DORA, firms must demonstrate that they can detect and respond to ICT-related incidents, including fraudulent activity, in a controlled and documented way. Fuzzy logic contributes to that objective by improving the accuracy and traceability of fraud detection processes.

It supports continuous monitoring and reduces false alarms that could otherwise flood incident management systems. In doing so, it helps maintain the integrity and resilience of financial operations, aligning directly with DORA’s intent.

“The future of fraud detection lies in systems that understand shades of gray. Fuzzy logic brings that human-like reasoning into automation, bridging the gap between static rule sets and opaque AI.”

– Chief Product Officer, Mark Medum Bundgaard, Partisia

The expert’s view reflects what many in the industry are starting to realize: technology alone is not enough. The key is interpretability and adaptability, and fuzzy logic delivers both.

Implementation challenges

Adopting fuzzy logic is not without hurdles. Designing meaningful membership functions requires domain expertise, and poorly constructed rules can produce inconsistent results. Integrating fuzzy systems with legacy transaction platforms also requires architectural flexibility.

Data quality is another limitation. Fuzzy systems are only as good as their input data. Inconsistent or incomplete transaction records reduce accuracy, which can negate the benefits of nuance.

Nevertheless, these challenges are technical, not conceptual. Most institutions already have the necessary data and infrastructure. What they need is a structured approach to implementation and continuous calibration. DORA checklist & Article 24 requirements for resilience

Partisia’s approach to secure, collaborative fraud detection

Fraud detection depends on analyzing sensitive transactional data that often spans multiple institutions. Sharing that data across borders or between banks raises compliance and privacy concerns, particularly under the General Data Protection Regulation (GDPR) and DORA’s ICT risk requirements.

Partisia’s privacy-preserving data collaboration platform allows institutions to share and analyze data for fraud detection without exposing the underlying information. Using Multi-Party Computation (MPC), different entities can jointly compute fraud risk scores across datasets while each keeps its data private.

This enables broader collaboration on fraud detection, reduces blind spots, and strengthens system-wide resilience. It also aligns with DORA’s expectation that institutions adopt privacy-respecting, verifiable methods for detecting ICT-related incidents.

In a financial system that increasingly values both data privacy and resilience, the combination of fuzzy logic for nuanced risk scoring and MPC for privacy-preserving analytics represents a practical, forward-looking solution.

2025.08.12