FATF compliance technology – how innovation drives global AML performance

Financial institutions are under pressure to prove the effectiveness of their anti-money laundering (AML) and counter-terrorist financing (CTF) programs, not just their existence. The Financial Action Task Force (FATF) sets the global standard, but compliance success now depends on how well institutions use technology to apply those principles in practice.

Core capabilities of FATF compliance technology

Modern FATF-aligned platforms combine analytics, automation, and privacy engineering to deliver real-time detection and transparent reporting. The objective is to replace manual control with measurable, data-driven assurance.Key capabilities include:

- AI-driven transaction monitoring – Identifies complex laundering patterns, reducing false positives and improving accuracy.

- Risk-based scoring engines – Continuously adjust risk profiles as new customer or transaction data is received.

- Advanced identity verification – Uses biometrics and behavioral analytics to ensure customer authenticity.

- Automated regulatory reporting – Prepares and submits Suspicious Activity Reports (SARs) to FIUs with consistent, traceable formatting.

- Cross-border data integration – Connects local AML systems to centralized frameworks, improving transparency and consistency.

How FATF technology supports practical compliance

Technology translates FATF’s global principles into real-world, repeatable processes. It ensures compliance activity is both proactive and measurable, aligning with specific FATF recommendations.

Key technology-driven applications include:

- Customer Due Diligence (Recommendation 10) – Automated KYC verification and continuous monitoring.

- Record Keeping (Recommendation 11) – Immutable digital storage for audits and investigations.

- Suspicious Transaction Reporting (Recommendation 20) – Automated alerts, triage, and structured reporting to FIUs.

- Cooperation and Information Sharing (Recommendation 31) – Secure channels for regulator and interbank intelligence exchange.

Integration with regulatory frameworks

FATF doesn’t operate in isolation. Compliance technology must connect global recommendations to regional and national laws.This integration ensures that systems remain consistent across different supervisory regimes while avoiding regulatory duplication.

Effective FATF compliance tools support alignment with:

- EBA AML Guidelines – Detailed operational expectations for risk-based AML programs.

- AMLD6 – The EU’s directive defining criminal liability for money laundering.

- DORA – Requirements for operational resilience in financial systems.

- GDPR – Standards for lawful data processing and privacy protection.

The compliance battlefield: Win the fight

Your firm is facing immense pressure from regulators like the FCA. New regulations like DORA and the upcoming eIDAS 2.0 are turning compliance from a burden into a battlefield. You're expected to manage risk, protect data under strict rules like GDPR, and avoid massive fines. Your current systems are simply not enough. Partisia is your strategic partner in building a more secure and profitable future.

What we solve:

- DORA & GDPR compliance

- eIDAS 2.0 & Digital Identity

and more.

Examples of FATF compliance technology in use

The industry’s adoption of FATF-aligned technologies shows a shift toward measurable performance and auditable transparency. According to the EY Global Financial Crime Survey 2024, financial institutions are advancing in several areas:- AI-driven AML monitoring systems that cut false positives by more than half.

- Federated analytics that let multiple banks share risk insights without revealing customer data.

- Blockchain-based audit logs that provide immutable proof of compliance for supervisors.

- Collaborative intelligence networks linking banks, regulators, and FIUs for typology detection.

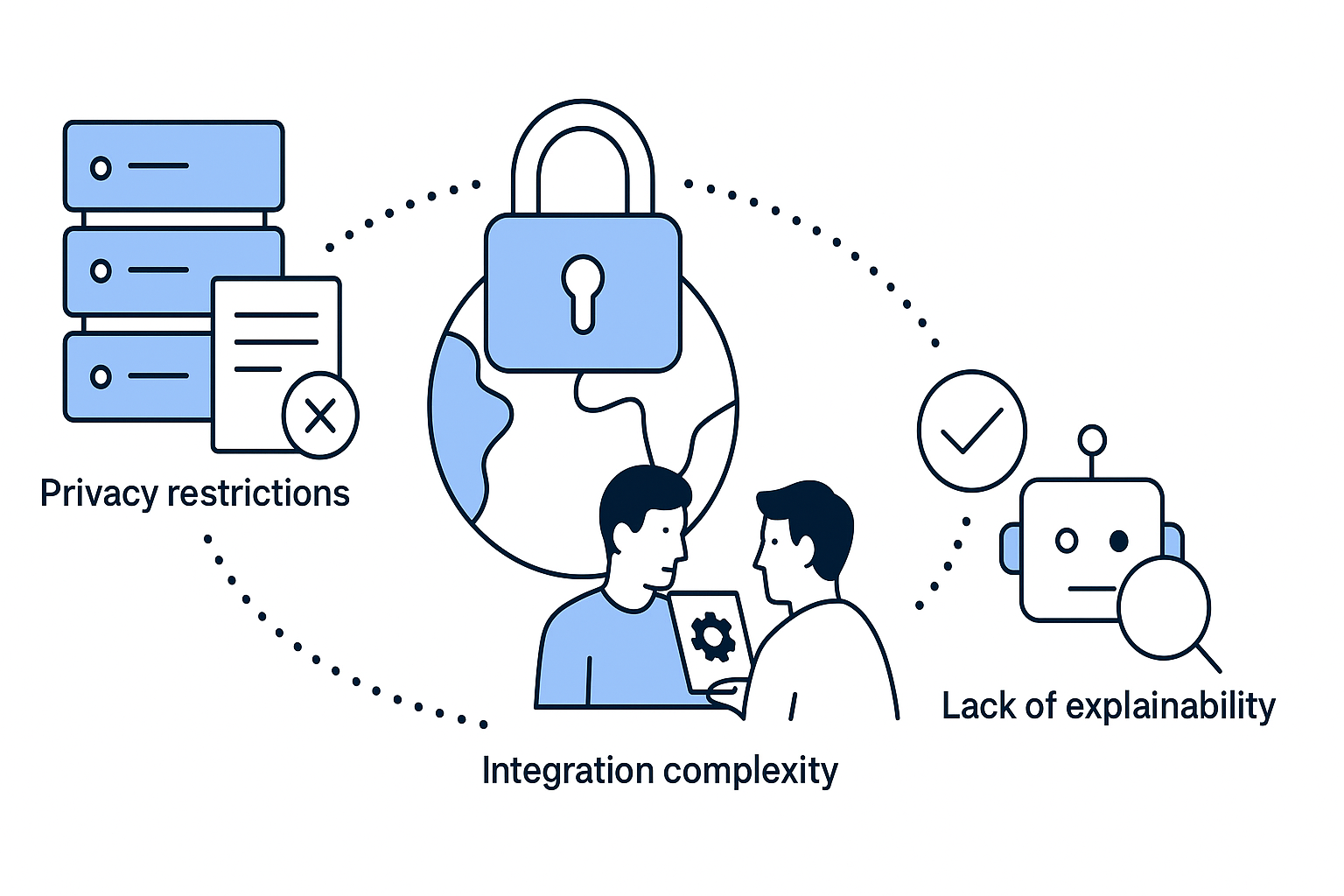

Common implementation challenges

Even with advanced technology, FATF compliance remains difficult to operationalize across jurisdictions. Financial institutions face a mix of technical, legal, and organizational barriers.The main challenges include:

- Data fragmentation – Multiple platforms and legacy systems limit unified monitoring.

- Privacy restrictions – GDPR and local data laws restrict cross-border data sharing.

- Integration complexity – New RegTech tools often fail to connect cleanly with core banking systems.

- Lack of explainability – AI models used in compliance need to produce transparent, regulator-approved logic.

Solving data privacy and jurisdictional barriers

FATF standards promote international cooperation, but data privacy and jurisdictional barriers often block implementation. Partisia’s privacy-preserving data collaboration platform enables financial institutions to comply with FATF standards while respecting confidentiality.Through Multi-Party Computation (MPC), institutions can:

- Run cross-institution AML risk analysis without sharing sensitive data.

- Support joint investigations with regulators and FIUs securely.

- Prove FATF-aligned detection and reporting effectiveness without breaching GDPR.

2025.10.30